Model portfolio - compounders

weekly performance report - compounders #10

Investmenttalk

A model portfolio contains large and midcap cap stocks whose growth is higher and more consistent return in equity. Compounders are companies that can compound shareholders’ value over the long run. The model portfolio invests in stocks listed in NSE500 and newly listed IPO.

Weekly report will come in tag name - weekly performance report - compounders#xx

Rebalancing report will come in tag name - Rebalancing portfolio - compounders#xx

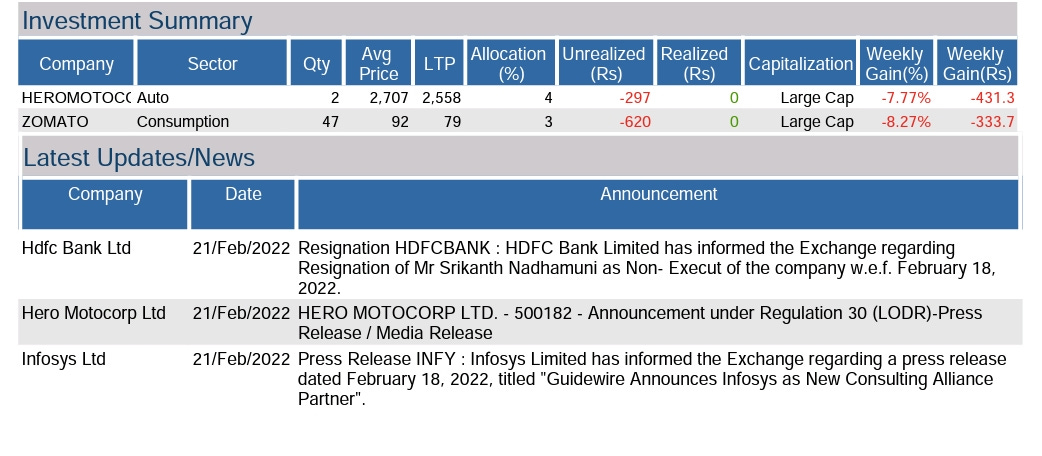

Please refer to the below report for the weekly performance and the Latest news/update in companies invested in the Model portfolio - compounders.

Model portfolio - compounders - 1 week returns (-2.58%) comparing to Nifty 50 index (-3.58%). In 1 Month returns (-2.04%) comparing to Nifty 50 index (-2.59%).

Model portfolio - compounders have very low volatility compared to the Nifty 50 index.

Dividend

Dividend received from hero motocorp ltd - Rs. 120 will be reinvested post-tax deduction. Dividend income not excessed rs.5000 so there will no be TDS.

Rs.120 dividend amount will be taxed as per slab rates.

Model portfolio - compounder : will tax dividend as 10% ( old tax regime - many retial investor or salaried person will come below 7.50 lakhs income range post all deductions).

Amount reinvested: Rs.108 in the model portfolio - compounder as a cash balance.

The total cash balance in the Demat account: Rs. 109.40

The normal rate of TDS is 10% on dividend income paid in excess of Rs 5,000 from a company or mutual fund. However, as a COVID-19 relief measure, the government reduced the TDS rate to 7.5% for distribution from 14 May 2020 until 31 March 2021.

Further, the dividend income is the taxable income and is taxed at the slab rates applicable for FY 2020-21 (AY 2021-22).

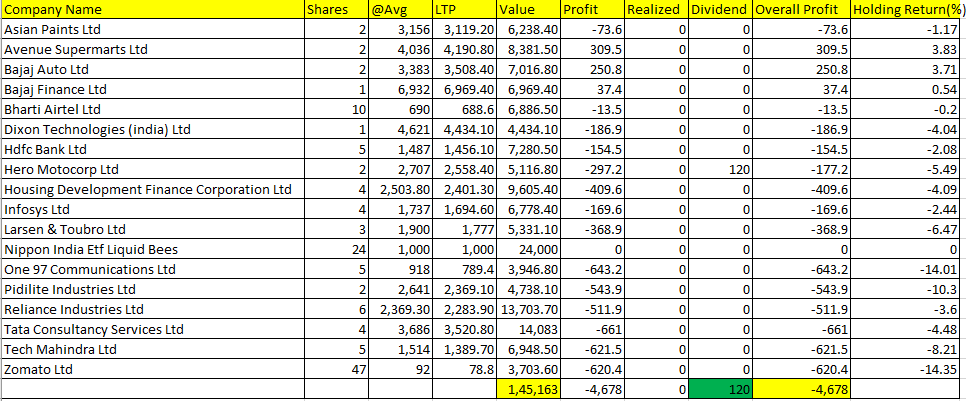

Please refer to the below latest portfolio returns.

Cash flow of Model portfolio - compounder ( 21st Feb to 27th Feb 2022).

The above model portfolio was created on 23th Jan 2022, It contains 16 equity stocks and 1 debit ETF.

16 stocks are in large and midcap companies, whose growth is higher and more consistent return in equity. Companies that can compound shareholders’ value over the long run.

1 debit ETF - Nippon liquid bees - Liquid funds invest in bonds having a maturity of up to three months. They are suitable to park the amount you have set aside to meet any emergency needs or any surplus money that you don't need for a few weeks up to a year. You can expect to earn better returns than what you would get from a bank account.

Model portfolio has 16.5 % allocated to cash - 1 debit ETF - Nippon liquid bees, If the market corrects further this quarter Q12022, those cash allocation will be utilized to buy more shares of existing companies in a model portfolio or new opportunities comes in the market ( eg: newly listed IPO, where growth is high . NSE may come up with IPO and list in exchange this year 2022).

Kindly like, share, and subscribe now to receive the newsletter directly to your email box.