Model portfolio - Long term investing

weekly performance report - LT investing #04

Model portfolio contains large, midcap cap stocks and ETFs ( domestic and international ). Invest in companies that can compound shareholders’ value over the long run. The model portfolio invests in stocks listed in NSE500 and newly listed IPO, ETF.

Weekly report will come in tag name - weekly performance report - LT investing#xx

Rebalancing report will come in tag name - Rebalancing portfolio - LT investing#xx

Please refer to the below report for the weekly performance and the Latest news/update on companies invested in the Model portfolio - LT investing.

Overall return:

Portfolio performance: 06th Jun 2022 to 10th Jun 2022

The total cash balance in the Demat account: Rs. 900.86

Cash flow:

Model portfolio - LongTerm Investing ( 13th May to 10 Jun 2022)

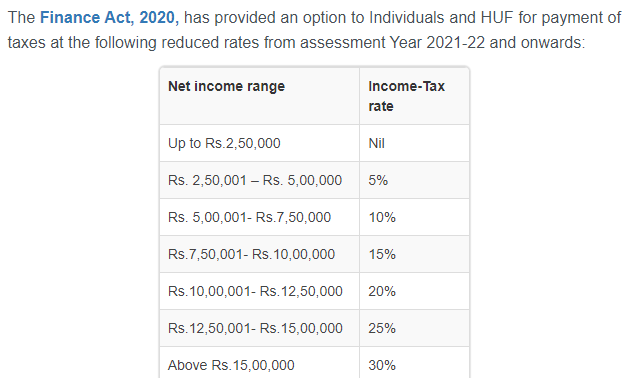

Tax on dividends - For Model portfolio - Long term Investing - I have taken 10% tax - Because it was taxed at shareholders as per their tax slab rate.

Most of the people will come in tax slab - 2.5 lakhs to 7.50 lakhs.

New tax slab I will never opt for it, it was only for people who do not pay rent for home and do not invest in ELSS and finally salary more than 8 lakhs.

For education purposes on TAX on Investment in the Model portfolio.

I will consider 10% tax on dividends, 15% tax on short-term capital gains, and 10% tax on Long term capital gains.

The above model portfolio was created on 13th May 2022, It contains 12 equity stocks and 1 debit ETF.

12 stocks are in large and midcap companies, whose growth is higher and more consistent return in equity. Companies that can compound shareholders’ value over the long run.

1 debit ETF - Nippon liquid bees - Liquid funds invest in bonds having a maturity of up to three months. They are suitable to park the amount you have set aside to meet any emergency needs or any surplus money that you don't need for a few weeks up to a year. You can expect to earn better returns than what you would get from a bank account.

The model portfolio has 37.30 % allocated to cash - 1 debit ETF - Nippon liquid bees, If the market corrects further this quarter Q3 -2022, those cash allocation will be utilized to buy more shares of existing companies in a model portfolio or new opportunities comes in the market ( eg: newly listed IPO, where growth is high . NSE may come up with IPO and list in exchange this year 2022).

Taxability of earnings:

Capital gains:

Equity shares - there is a 15% tax on short-term capital gains and a 10% tax on long-term capital gains.

If the ETF (Gold, Debt) are sold after 3 years from the date of investment, gains are taxed at the rate of 20% after providing the benefit of inflation indexation.

If the ETF (Gold, Debt) is sold within 3 years from the date of investment, the entire amount of gain is added to the investors' income and taxed according to the applicable slab rate.

No tax is to be paid as long as you continue to hold the ETF.

Dividends:

Dividends are added to the income of the investors and taxed according to their respective tax slabs. Further, if an investor's dividend income exceeds Rs. 5,000 in a financial year, the fund house also deducts a TDS of 10% before distributing the dividend.

Kindly like, share, and subscribe now to receive the newsletter directly to your email box.