Model portfolio - long term investing

weekly performance report - LT investing # 90

A model portfolio contains large, midcap cap stocks and ETFs (domestic and international). Invest in companies that can compound shareholders’ value over the long run. The model portfolio invests in stocks listed in NSE500 and newly listed IPO, ETF.

Weekly report will come in tag name - weekly performance report - LT investing #xx

Rebalancing report will come in tag name - Rebalancing portfolio - LT investing #xx

Please refer to the below report for the weekly performance and the Latest news/update on companies invested in the Model portfolio - LT investing.

Overall return:

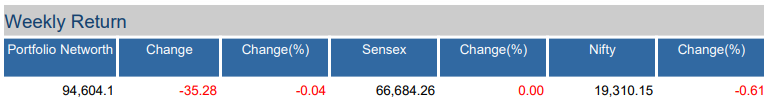

Portfolio performance: 14th AUG 2023 to 18th AUG 2023

Model portfolio - LT investing - 1 week returns (-0.04%) compared to Nifty 50 index (-0.61%)

Current holdings:

Cash flow:

The total cash balance in the Demat account is Rs. 843.10

Model portfolio - Long-term Investing: (12th AUG 2023 to 19th AUG 2023)

The above model portfolio was created on 13th May 2022, It contains 11 equity stocks and 5 ETFs.

Currently it has 01 stocks are in large and midcap companies, whose growth is higher and more consistent return in equity. Companies that can compound shareholders’ value over the long run.

ETF (0 - domestic and 0 - international) and 1 debit ETF - Nippon liquid bees - Liquid funds invest in bonds having a maturity of up to three months. They are suitable to park the amount you have set aside to meet any emergency needs or any surplus money that you don't need for a few weeks up to a year. You can expect to earn better returns than what you would get from a bank account

The model portfolio has a cash balance in the Demat account: Rs.843.10 and 97.20% allocated to cash - 1 debit ETF - Nippon liquid bees), If the market corrects further this quarter Q3 -2023, those cash allocations will be utilized to buy more shares of existing companies in a model portfolio or new opportunities come into the market ( eg: newly listed IPO, where growth is high. NSE may come up with IPO and list in exchange this year 2023)

Kindly like, share, and subscribe now to receive the newsletter directly to your email box.