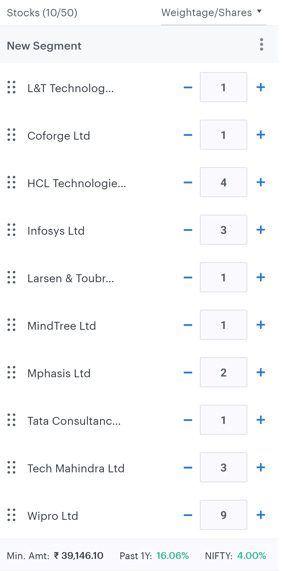

Nifty IT provides investors and market intermediaries with an appropriate benchmark that captures the performance of the IT segment of the market. Model portfolio - NIFTY IT - invested in NIFTY IT index companies and allocated 10% to each stock in the NIFTY IT index.

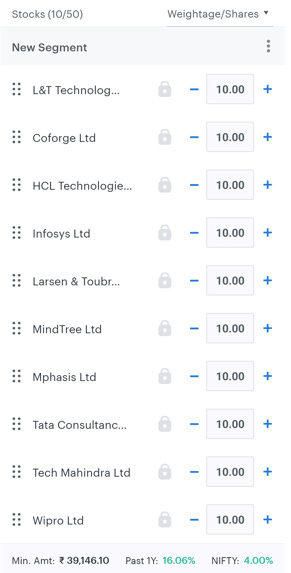

Model portfolio - NIFTY IT - All 10 stocks were invested as 10 % allocation

NIFTY IT companies have high prices in 6 of 10 index stocks and due to that reason there will be variation in stocks weightage below, it was auto-adjusted weightage as per 10% allocation with the market price. So every year as per performance and NIFTY IT index stocks rebalance. We will also add or remove stocks from the Model portfolio - NIFTY IT - and allocate 10% to each stock and as per-market price stock weightage will be auto-adjusted.

Model portfolio - Nifty IT

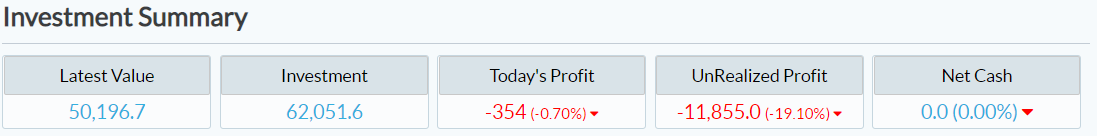

Nifty IT has fallen 19.10 % from our investment. It will perform well when the market starts consolidating and performing again. The IT sector will do very well for the next decade, so we can use this opportunity to add more SIP when the market consolidates.

SIP #1

As per the Model portfolio - Nifty IT - allocation 10% to each stock.

Monday ( 16/05/22 ) - I will invest below SIP in the model virtual portfolio - once the market opens at 9.15 AM

Required additional capital: Rs.40000

please refer to below weightage/allocation.

Shares QTY need to be added on Monday (16/05/2022)

10% weightage allocation:

Latest News stocks invested in the Model portfolio - Nifty IT

Under the proposed merger, all shareholders of Mindtree will be issued shares of LTI at the ratio of 73 shares of LTI for every 100 shares of Mindtree. The new shares of LTI so issued will be traded on the NSE and BSE. Larsen & Toubro Limited will hold 68.73 % of LTI after the merger.

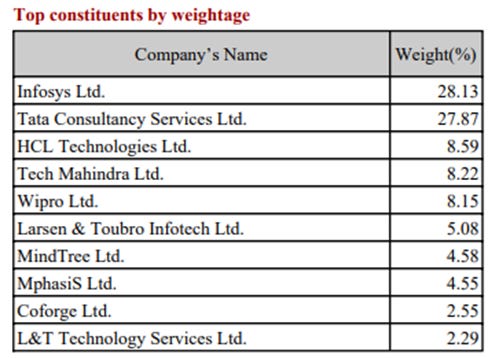

Please refer below actual NIFTY IT index and companies in the NIFTY IT index - Constituents.

Kindly like, share, and subscribe to receive the newsletter directly to your email box.